Despite bans put in place by the U.S. and Europe on the supply of electronic components to Russia, dozens of Russian microelectronics suppliers continue to obtain and resell imported chips to Russian arms manufacturers successfully.

Without these Western chips, Russia would not be able to produce key weapons — like missiles, drones, and self-propelled howitzers.

To prove that this line of supply continues to operate three years into Russia’s full-scale invasion, the Kyiv Independent tried ordering American microchips from Russian trading companies, posing as a Russian defense producer.

We obtained a list of Russian firms supplying Western microcircuits to the Russian defense industry from leaked emails of the Russian state holding Ruselectronics. The Kyiv Independent obtained access to the leak together with OCCRP.

(The Kyiv Independent’s first investigation based on the leak is available here. The investigation focused on the continued export of Russian weapons during the full-scale war.)

We combed through the emails for mentions of the supply of American and European chips to Russia and followed the traces of the described transactions.

According to the leaked letters, after the start of the full-scale invasion, companies of the Ruselectronics holding requested large volumes of various American and European chips from Russian suppliers — and got confirmation that they could be supplied, despite sanctions. The leaked emails cover the first few months of the full-scale invasion in 2022.

Through the emails, the Kyiv Independent identified an ecosystem of companies that came to the aid of Ruselectronics holding by building new supply chains for banned components.

Using customs data, we also discovered a huge network of their foreign suppliers, mostly from China and Hong Kong.

These records, together with our undercover experiment, prove that American and European-branded chips continue flowing to Russia — the country that started the largest war in Europe since World War II.

Response to sanctions: Increase purchases of American chips

The U.S. and EU imposed sanctions and export restrictions immediately on the first day of Russia’s invasion of Ukraine on Feb. 24, 2022, and some even the day before. The restrictions, among other things, banned American and European chips from entering Russia, whose defense sector relies heavily on their use in producing weapons.

Russia wasn’t ready for it. From the leaked emails, it’s clear that the producers had no significant stockpile of chips.

On the second day of the invasion, one Ruselectronics employee emailed notes from an internal meeting to two colleagues. It mentions that “delivery times for electronic components had increased, and prices had risen.”

The letter concludes that the holding would need to buy a year’s worth of stock of electronic components.

This and other emails suggest that the Russian arms manufacturer wasn’t preparing for a protracted war. It didn’t have extra stocks of imported chips at the start of the invasion but began procuring them immediately after the start of the invasion, bypassing the fresh restrictions.

In April 2022, two months after the start of the invasion, Ruselectronics companies prepared proposals on how to reduce the risks of disruptions in the procurement of electronic components.

Among other things, the proposals called for allocating additional funding to create stockpiles of electronic components.

But the leaked letters reveal that suppliers faced difficulties procuring the electronics.

In March 2022, Elitcom, a Russian supplier of Ruselectronics holding, wrote to say that it would fail to deliver chips produced by the American company Analog Devices on time. The contract for the chips was signed in December 2021, and one of Ruselectronics’ subsidiaries expected their delivery in May 2022.

Elitcom explained that due to the Russian invasion, the American manufacturer had stopped deliveries to Russia, and Analog Devices’ official distributor “did not confirm its readiness” to fulfill the contract.

But Elitcom had a plan and said it could arrange the supply of the necessary Analog Devices chips, despite sanctions. The company was offering to do so with the help of unnamed “foreign partners” who confirmed the chips would arrive in September-October 2022, several months later than originally planned.

Similar cases occurred across the sector. Around that same time, a Russian electronics supplier, TestKomplekt, emailed a Ruselectronics’ subsidiary to warn that due to foreign restrictions, it had revised the terms of supply of American-branded chips, such as Analog Devices, Texas Instruments, Microchip Technology, Altera, Maxim Integrated, and others. Not a problem — the company was still ready to supply them, but at new prices.

The leaked emails contain direct evidence that Russian defense manufacturers can’t produce weapons without Western chips, nor can they be substituted with analogs.

For example, a sanctioned Ruselectronics’ subsidiary, the Istok Research and Production Corporation, argued that it needed to purchase certain American chips produced by Analog Devices because Russian and other analogs “do not comply with the design documentation” of the enterprise.

The use of other chips “is impossible,” an internal note says.

“For the Russians, this stuff is absolutely critical,” explains James Byrne, senior associate fellow at the Royal United Services Institute (RUSI), a London-headquartered security think tank. “They can't build missiles without it. It's not like they're just going to give up.”

But the Russian arms manufacturers didn’t have to give up the Western chips. There were those willing to supply them.

Invisible elements of a long supply chain

An unobvious but important detail illustrated by the leaked emails is that Russian arms manufacturers don’t import Western chips directly from abroad. They didn’t do so even before the full-scale invasion.

Instead, Russian arms manufacturers buy imported circuits within Russia.

Whenever they need electronics, they tap into a vast network of Russian suppliers of imported electronic components like Elitcom or TestKomplekt. The network is a mix of state-owned and private companies that specialize in purchasing American and European chips.

Some of them openly advertise the sale of American chips on their websites even now, in 2025, in the fourth year of the Russian war.

It was these companies that came to the rescue of the Russian defense industry after the introduction of unprecedented Western export bans and sanctions, setting up workarounds to supply chips to Russia.

These companies don’t publicly advertise that their clients are Russian defense manufacturers. It is only through internal correspondence and access to contracts, which aren’t public, that it becomes clear that these private firms with flashy websites are actually the lifeline of Russian missile production.

The leaked emails show that after the start of Russia's full-scale war against Ukraine and the imposition of restrictions and sanctions, more than two dozen Russian providers of Western chips responded to Ruselectronics’ growing demand.

Among them were Russian companies Modern Digital Technologies, Imotek, Elsup, AST Components, Orion-Electronika, Altex, Elesar-Grupp, Trade House Alfa-Komplekt ECB, Communication Systems Equipment, RTKT, GC Electromir, MTG, Electronintorg, and others.

They confirmed their readiness to supply hundreds of different American-branded chips in response to requests from Ruselectronics’ subsidiaries in March–April 2022.

Some Russian chip suppliers took the initiative and approached representatives of Ruselectronics to advertise their capabilities, knowing they would struggle to obtain chips.

In March 2022, the Russian design center Kristal wrote a letter to a Ruselectronics representative, informing him that the company had supply channels for imported electronic components from Texas Instruments, Analog Devices, Maxim, Microchip, Micron, NXP, Xilinx (AMD), Qorvo, and Broadcom. Kristal offered a meeting to discuss cooperation.

“Together with foreign partners, we have access to global distributors of electronic components,” Kristal’s CEO Leonid Zotov boasted in an email sent on the 19th day of Russia's full-scale war against Ukraine.

Who is behind suppliers like Kristal? Among the owners are a retired Russian major general, medium-sized entrepreneurs, a Russian oligarch, as well as employees of companies united in the state-owned Ruselectronics holding, or the Russian state defense corporation, Rostec, itself.

For example, Elsup’s owner is Vladislav Borodovitsyn. According to his Instagram page, he previously held a position as an employee of a research institute that is jointly controlled by Rostec and the investment company Sistema, owned by Russian oligarch Vladimir Yevtushenkov.

Kristal is also controlled by Rostec and oligarch Yevtushenkov.

Electronintorg is part of the state-owned Rostec’s subsidiary Ruselectronics.

Among the co-owners of AST Components, we found the retired Russian Major General Magomed Tolboev, who was also an aspiring politician, and his son Ruslan.

Commercial proposals sent by Russian suppliers at Ruselectronics’ request included American electronic components used in Russian missiles and other weapons.

Among the offers, the Kyiv Independent identified a number of American chips that had been found in Kinzhals — Russian ballistic missiles that carry a warhead of nearly 500 kilograms used in strikes on Kyiv and more distant cities, killing civilians.

According to the leak, Russian intermediary companies were also ready to supply U.S. chips that are used in Russian Kalibr and R-77 missiles, as well as in the Tornado-G system capable of launching 40 rockets at once and in the Giatsint-S, a tank-mounted gun.

Although the leaked Ruselectronics’ emails don’t extend beyond May 2022, Russian intermediaries did not exhaust their ability to supply the Russian defense industry with Western chips.

The Kyiv Independent managed to obtain Russian tax records from 2024 with a list of contractors for one Ruselectronics’ subsidiary: the Istok Research and Production Corporation.

In 2024, Istok continued to receive supplies from the majority of the Russian providers of imported circuits that we encountered in the leaked emails.

The Kyiv Independent decided to try and order American chips through Russian suppliers in February 2025 — and was successful.

Buying American chips for Russian missiles

To confirm that the flow of Western chips to Russia is not a fiction, we carried out an undercover experiment.

The Kyiv Independent took on the role of an employee of a real Ruselectronics’ subsidiary, the Almaz research and production enterprise, which produces electronic systems for military equipment.

Surprisingly, the most difficult aspect of the experiment was to create an email account with a Russian email service, as they are blocked in Ukraine. When that was done, trying to buy banned Western chips in Russia was easy.

The Kyiv Independent prepared a request for a commercial proposal on behalf of Almaz, asking for circuits produced by American-headquartered companies, and sent the request to two dozen Russian suppliers of American chips.

Ten of them responded, confirming their ability to deliver the required chips.

The Russian companies Imotek, AST Components, Elsup, Altex, RTKT, and Vneshtekhsnab confirmed they were ready to deliver chips in 1.5 to three months.

Modern Digital Technologies, Electromir, and Imotek sent their offers, specifying the years of chip production. They included chips from Analog Devices, Texas Instruments, and Atmel manufactured in 2022-2024.

One of the Russian companies, Elesar-Grupp, sent a full list of the chips it currently had in its warehouse, indicating their quantity. There were millions of chips of famous American and European brands.

The list, provided to the Kyiv Independent when it reached out under the guise of an Almaz employee, included chips from American manufacturers Analog Devices, Texas Instruments, Microchip Technology, Xilinx (AMD), ON Semiconductor, Intel, Dutch NXP, German Infineon, and many others.

Among them were those used in Russian missiles and attack drones.

In the fourth year of Russia's full-scale war in Ukraine, those American and European chips are still available to Russian intermediary firms, and through them — to Russian arms manufacturers.

Who is helping Russia circumvent the export bans on Western chips?

Due to strict export bans imposed after the start of the full-scale invasion, Western chipmakers have stopped direct deliveries to Russia and banned official distributors from supplying their parts to Russian companies.

Instead, Western chips enter Russia through third countries that have not imposed restrictions.

The main suppliers of American chips to Russia are China and Hong Kong.

Customs data since the start of the full-scale invasion in February 2022 shows that dozens of companies, mainly registered in Hong Kong and China, sent Western chips to Russian electronic component traders cooperating with Ruselectronics holding.

The companies are either Chinese providers of Western microelectronics with many years of experience or newly established entities without websites and public contact information.

According to ImportGenius, the Hong Kong-based electronic component seller Analog Technology has supplied Western chips to the Russian companies Modern Digital Technologies and Imotek since 2022.

Hong Kong-based Analog Technology was established in 2011 and positions itself as a seller of chips “of all famous worldwide brands.” It supplied all well-known American and European chip brands to Russian firms despite Western export restrictions, according to trade data.

Another Hong Kong-based company, Icscan Electronic, registered in 2022, presents itself as a “famous international one-stop purchasing service provider of electronic components,” and has sold chips of various American brands to Russian Elsup.

Chinese Berton Electronics, which claims to be “an agent of electronic components of well-known brands,” sold Western-branded chips to Russian Modern Digital Technologies.

In their turn, Russian companies Elsup, Modern Digital Technologies, Imotek, and other chip traders resold imported circuits to Ruselectronics holding.

The following chart provides a glimpse into the scale of the Chinese distribution network of Western chips.

The data provides insights into the link in the chain that gets U.S. chips into Russia despite export bans. In this chain, Chinese suppliers resell the chips to Russian buyers that then supply them to the Russian defense industry.

How many times chips are sold and resold before ending up in a Russian defense company is anyone’s guess.

According to customs records, American chips are produced in different countries, including the U.S., China, Taiwan, Malaysia, the Philippines, and others. In other words, some of these chips were most likely manufactured in American factories located outside the U.S.

“The key Western producers have several production facilities in countries like China, Vietnam, the Philippines, Malaysia, and a few in Thailand and Taiwan. Some of these are Chinese factories working on license, while others are daughter companies,” says Erlend B Bjortvedt, founder of Corisk, an Oslo-based consulting company that explores sanctions and sanction evasion.

Bjortvedt adds that “this does not reduce their liabilities to follow sanctions”. “This liability includes daughter companies and U.S. and EU citizens in the management or board of daughter companies abroad,” he explains.

How can the flow of Western chips into Russia be stopped?

Further sanctions on foreign companies that help Russia obtain scarce weapons components, as well as increased compliance by Western manufacturers, are two key steps to reduce such supplies, experts say.

“When a product that is prohibited for sale to Russia, according to U.S. rules, goes from China to Russia, this is not a violation from China's perspective. However, it would be a violation of sanctions from the U.S. point of view,” explains Vladyslav Vlasiuk, Ukraine's presidential commissioner for sanctions policy.

“That's why Chinese companies that supply microelectronics to Russia appear on U.S. sanctions lists,” Vlasiuk explains.

It is noteworthy that half of the Chinese chip suppliers to Ruselectronics holding identified by the Kyiv Independent, as well as their Russian buyers, are not yet under U.S. sanctions. That is, their activities have not yet been noticed by the authorized U.S. sanctions authorities.

The Kyiv Independent reached out to dozens of Chinese companies mentioned in this article for comments, but did not receive any replies by the time of publication.

James Byrne of RUSI spoke to the Kyiv Independent about his experience of communicating with chip manufacturers. According to him, they complain that they have limited visibility, meaning they can only see “one or two steps down with the chain.”

“If you're Texas Instruments or Intel, you have large distributors. The distributors sell components to all sorts of entities all over the world. Let's say you sell to some distributor in Hong Kong, and then they sell to another entity in Hong Kong, and that entity ships them to the Russians. I think it's a difficult problem to solve, but it doesn't mean it's impossible.”

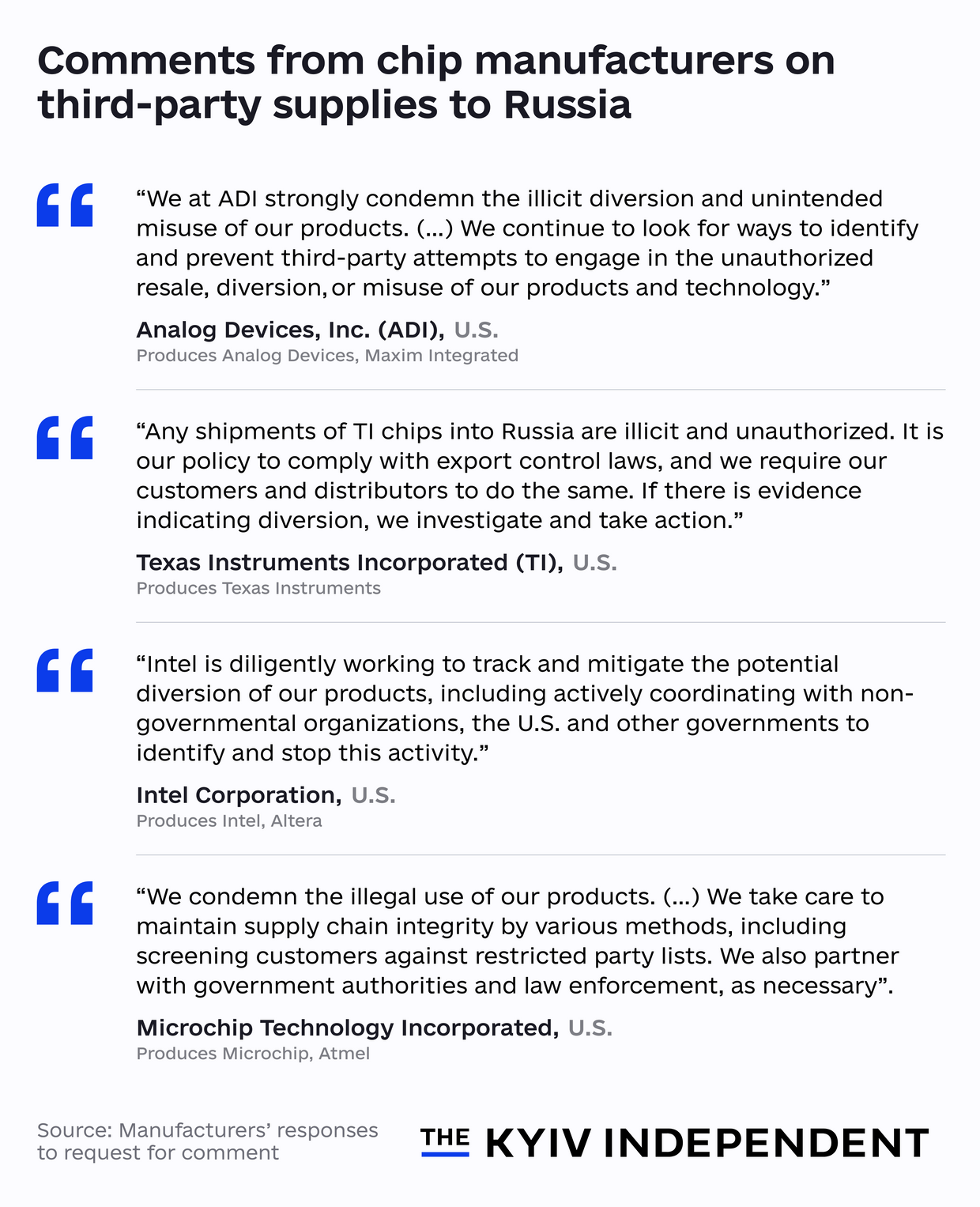

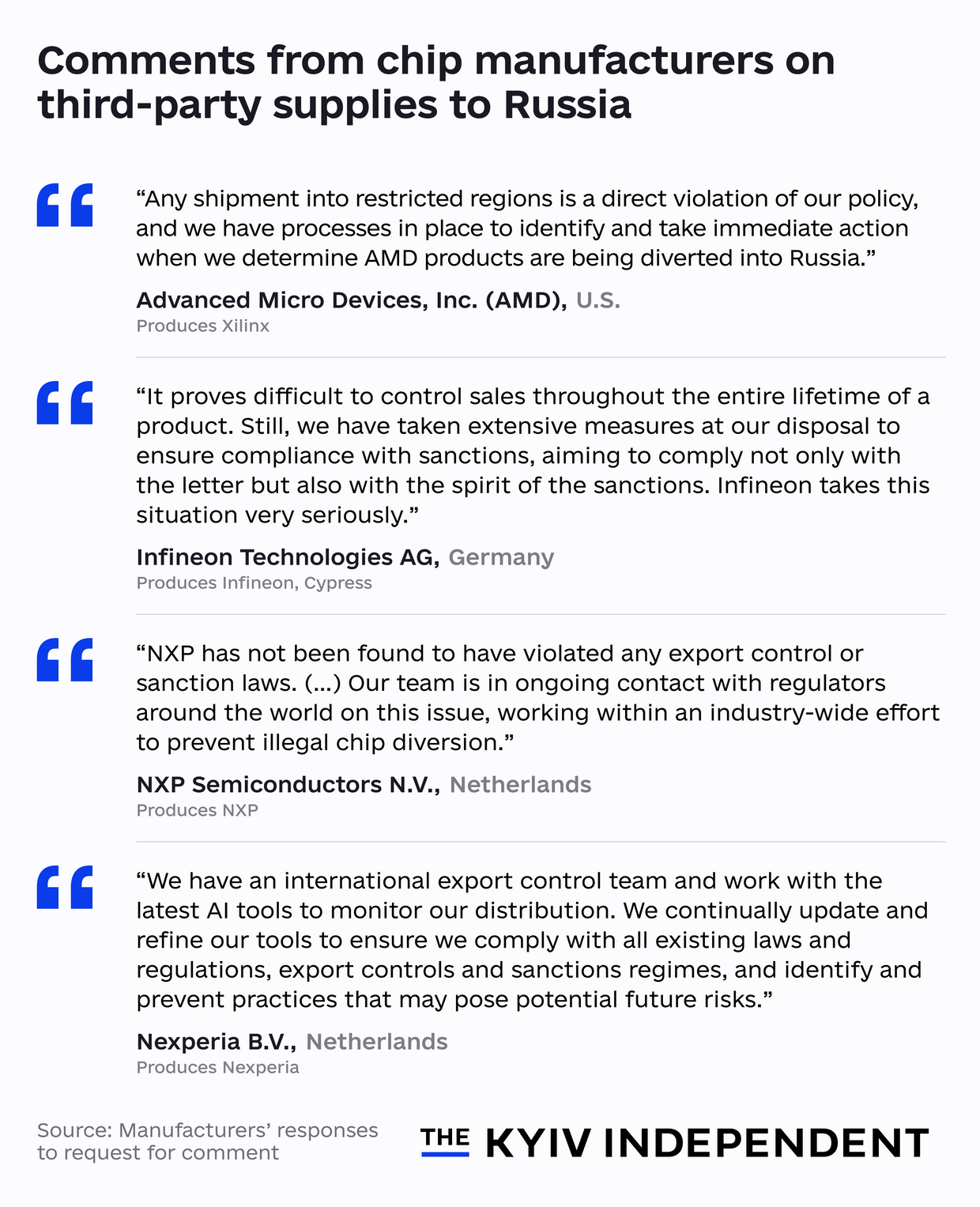

The Kyiv Independent contacted all the Western chipmakers mentioned in the article. Those who responded called the resale of their chips to Russia illicit and unauthorized, condemning it.

Large manufacturers can tighten control over who they sell banned goods to and refuse risky customers, some of the experts say.

“Western chips manufacturers have had tremendous growth and profits over the last decades, but they have not invested in compliance and internal investigation,” says Erlend B Bjortvedt, who works closely with customs data analysis at Corisk.

“One company I researched had 60,000 employees but did not see big and obvious red flags in their value chain,” he says.

“The loopholes in the digital components industry can be closed by forcing producers to invest in internal control resources through preventive investigations with strong penalties, and by deterring third parties through forceful secondary sanctions of foreign banks,” according to Bjortvedt.

Until that happens, American and European components make it possible to produce new batches of Russian weapons that attack Ukrainian cities and kill civilians.

Note from the author

Hi, this is Alisa Yurchenko, the author of this story.

I’m writing this note shortly after reading the news that the U.S. President Donald Trump ordered a suspension of military aid to Ukraine — a move that will manifest, among other things, that Ukraine might not have the way to protect itself from the Russian missiles. It adds to the bitterness of this moment is the understanding that Russian missiles that have been hitting Ukraine in the past three years would not have been produced if it wasn’t for the Western chips and other components.

Stories like this can create the wrong impression that export restrictions on critical components to Russia have failed. But they did have some effect. The need for workarounds made the chips 40 percent more expensive for Russian importers. We see it in the leaked emails dating back to the first months of Russia's full-scale invasion of Ukraine. Another, even more important result is a reduction in Russian imports of digital components and chips after December 2022, according to sanctions analysts. The trade through intermediaries has slowed down, they say. This gives us hope that if the pressure on Western chip sales through China, Hong Kong and other third countries is increased, Russia will not be able to produce missiles and other weapons.

If you want to help us do more investigations like this, please consider becoming a member of the Kyiv Independent. Our work is funded by our readers.

.png)

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)  3 hours ago

1

3 hours ago

1

Comments