Rivian (RIVN) will report first quarter earnings after the bell on Tuesday as the pure-play EV maker shows investors whether it is still on the long path toward profitability as President Trump's tariffs on auto parts start to bite.

For the quarter, Rivian is expected to report revenue of $981.21 million, a steep drop compared to the $1.73 billion reported last quarter and the $1.204 billion a year ago. The company is expected to post an adjusted EPS loss of $0.79 with an adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) loss of $546.4 million.

A big part of the drop in Q1 revenue resulted from the company posting fewer deliveries due to seasonality and the effects of the wildfires on the state of California, where many Rivian purchases are made. The company said in early April that it produced 14,611 vehicles at its manufacturing facility in Normal, Illinois, and delivered 8,640 vehicles, in line with its expectations, and reaffirmed its 2025 target of deliveries between 46,000 and 51,000.

Looking ahead, analysts will be interested to see if Rivian can repeat a notable feat from Q4, where the company posted a "gross profit" for the quarter, driven by "improvements in variable costs, revenue per delivered unit, and fixed costs."

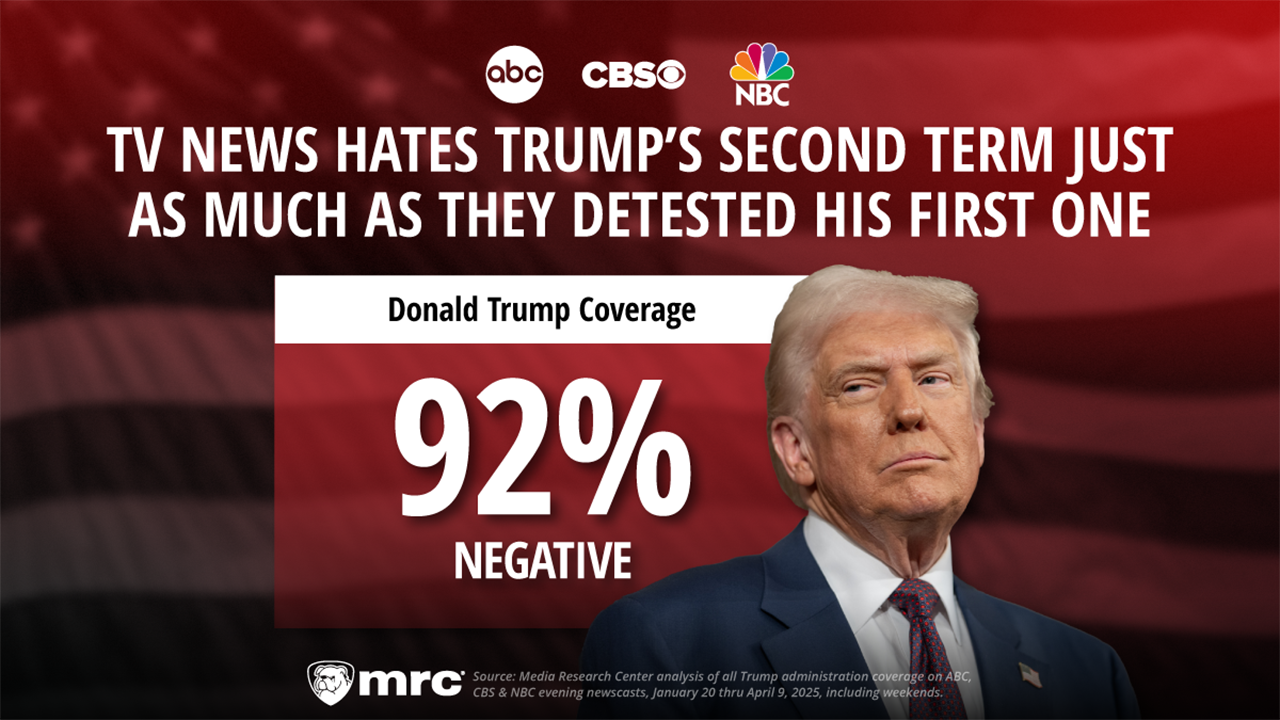

Those continued improvements in cost-cutting will now come face to face with Trump’s auto tariffs, which will raise the company's bill of materials (BOM) figures for each EV sold. Internal components, battery cells, and even steel and aluminum tariffs will likely hit Rivian, though as a US producer, it will have the ability to get "offsets" for some tariffs on foreign-made parts.

Read more: The latest news and updates on Trump's tariffs

In terms of guidance, Rivian previously issued a 2025 full-year adjusted EBITDA loss projection in the range of $1.7 billion to $1.9 billion. As with many other automakers, Trump's tariffs are making past projections unreliable, and most expect Rivian to withdraw its guidance until more tariff clarity is reached.

Of importance is the future of United States-Mexico-Canada Agreement (USMCA) parts and how long those parts will be exempt from tariffs. The administration is expected to give guidance on that shortly.

Rivian's production ramp-up of its upcoming R2 will be on the agenda as well. The company is targeting a 2026 launch, and much of the factory build-out is dependent on a "conditional commitment" it won from the Department of Energy (DOE) for a $6.6 billion loan. The loan, part of the DOE's Advanced Technology Vehicles Manufacturing program, would support the construction of Rivian's upcoming assembly plant outside of Atlanta.

.png)

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)

Comments