The following is the March 4, 2025 edition of our Ukraine Business Roundup weekly newsletter. To get the biggest news in business and tech from Ukraine directly in your inbox, subscribe here.

This week’s newsletter was originally going to be about the Trump–JD Vance–President Volodymyr Zelensky clash in the Oval Office and the subsequent collapse of the minerals deal — itself a shocking turn of events after weeks of tense negotiations.

But then, apparently as punishment for Zelensky not being “grateful enough,” as Vance put it, or as Trump and others have said, for “not being ready for peace,” reports sufaced the U.S. was halting military aid to Ukraine. Understandably, Ukrainians were outraged at the decision — we did a piece collecting reactions. Read it here.

The freeze reportedly goes into effect immediately, impacting over $1 billion in weapons and ammunition and affecting not only future aid but also weapons already in transit.

One of the most worrying aspects of the freeze in the immediate future is how Ukraine will replace the U.S.-provided air defense missiles that help protect Ukrainian cities from Russian aerial attacks.

Beyond the shock of the U.S. pulling its support for Ukraine at a time like this, the impact of Ukraine being unable to protect its skies could have repercussions that extend for generations.

Less protection means more civilian deaths and more damage to infrastructure. A less safe Ukraine means more people will flee abroad, which puts strain on both Europe's and Ukraine’s economies. That’s fewer people in Ukraine to help with recovery efforts post-war. Further damage to infrastructure means higher costs to rebuild.

But the loss of the U.S. — the world’s largest military superpower — as an ally runs the risk of a Russian victory in Ukraine and, ultimately, the disappearance of Ukraine itself.

And what would that mean for the world? Truth be told, it saddens me to have to repeat points I’ve made in this newsletter and elsewhere since the start of the full-scale invasion, but apparently, the world needs reminding.

Ukraine’s grain exports feed millions of people around the world. If those exports stop, even temporarily, people will be left without food, and prices will rise — all over the world. It happened at the start of the war and can happen again.

Millions — yes, millions — of Ukrainian refugees would flee across the border into Europe, causing a crisis. I hardly doubt any European country is ready for it.

Russia would be in possession of all of Ukraine’s natural resources, and all those “minerals” everyone has been talking about would go to benefit Vladimir Putin and his cronies; it would be in control of the military-industrial complex that has been created in Ukraine over the last three years. Russia would be richer and stronger, and the world would be less safe.

One thing that can and should be done to counteract the Trump administration’s move away from Ukraine and toward Russia — Europe must fully seize the some $200 billion of frozen Russian assets and send them to Ukraine.

Bonds take a dip

Markets have responded to the Zelensky-Trump-Vance showdown, with Ukraine's international bonds falling to their lowest point in over a month on March 3 as optimism wanes around a quick end to the war in Ukraine, Reuters reported.

According to Tradeweb data cited by Reuters, the 2036 maturity experienced the steepest decline, dropping 4.5 cents to 60.775 cents on the dollar and reaching a one-month low. Bonds tied to economic performance declined the most, with trading activity remaining high, one trader told Reuters.

"The new U.S. administration calls for pessimism," Paul McNamara at GAM told Reuters. "I see no economic reason to invest."

Read more here.

Storm brewing?

Late last week, on Feb. 28, just before Vance and Trump ambushed Zelenksy in the Oval Office, three of Ukraine’s major pharmaceutical companies experienced their own unpleasant surprise.

Ekonomichna Pravda reported, citing its source, that Ukraine's National Police had conducted searches at the offices and employee homes of Ukrainian pharmaceutical giants Arterium, Farmak, and Darnytsia.

"Those who are conducting searches are requesting information that could be obtained by simply sending a request. Everything is reminiscent of the “Mazepa case,” the source told EP.

The “Mazepa case” in question refers to Ukrainian investor and businessman Ihor Mazepa, who in early 2024 was yanked out of his car at the border with Poland and searched by the police, while his accounts were frozen. It was widely considered punishment for speaking out against heavy-handed treatment by law enforcement on businesses.

Why the raids? It’s not exactly clear yet. Zelensky’s administration could be putting pressure on the industry after he ordered the government to do something about “unreasonably high drug prices” in Ukraine.

After Zelensky’s statement about pricing, the government capped the markup of drug prices at 35% for over-the-counter drugs, and the Health Ministry announced that the price of the 100 most popular drugs would come down by 30% on March 1.

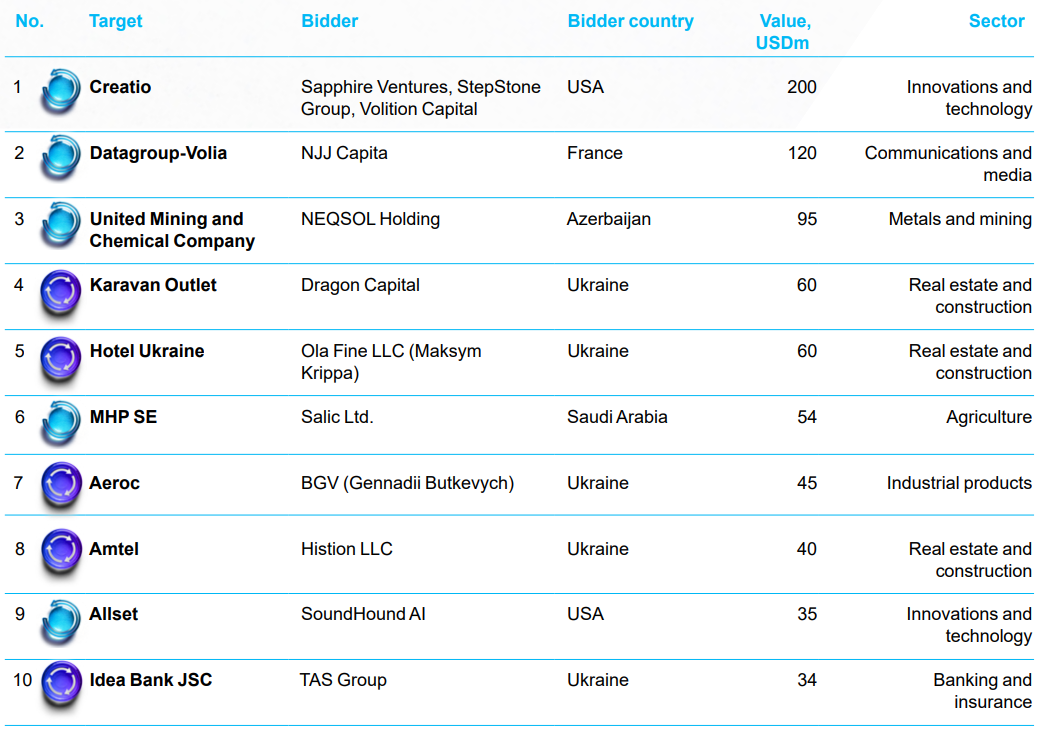

M&A: Staying the course

In other news — M&A deals in 2024 showed relative stability despite the war, with the total volume of deals, 49, equal to that of 2023 and a disclosed total deal value of around $1.1 billion, KMPG said in a recent report.

“Despite a 15.7% decline in total overall deal value, adjusted figures that exclude exceptionally large transactions indicate a 40.5% increase,” the Kyiv-based accounting firm wrote.

Ukrainian capital staying in the country due to wartime currency restrictions, war risk insurance mechanisms, and government-led infrastructure recovery initiatives have all contributed to continued M&A activity.

It has also been helped along by Ukraine’s privatization efforts, which delivered record revenues of Hr 12 billion ($300 million) in 2024, KMPG said in its report.

Read the full report here.

What else is in the news

EBRD lowers Ukraine’s 2025 growth forecast amid inflation, war impact

The European Bank for Reconstruction and Development (EBRD) has lowered its 2025 growth forecast for Ukraine’s economy, now expecting 3.5% growth instead of the previously projected 4.7%. The downgrade comes as inflation accelerates due to the ongoing war, which reached 12% in December.

Revolut denies operating in Ukraine without license after central bank's pushback

After the London-based bank announced it had started offering some services in Ukraine on Feb. 11, Ukraine’s central bank came out and said Revolut had not obtained the proper licence to do so. Revolut has denied any wrongdoing, saying that it is merely offering EU accounts to Ukrainian residents on a cross-border basis and that it does not plan to open Ukrainian accounts without further authorization.

Ukraine's DTEK plans LNG import deal by April, Bloomberg reports

Ukraine’s largest private energy company, DTEK, is in talks with several suppliers for a two-year liquefied natural gas import contract into the country, CEO Maxim Timchenko said in an interview at IE Week in London, Bloomberg reported. In June 2024, DTEK signed the first major deal with U.S. Venture Global to supply LNG to Ukraine for two years. It was the first time Ukraine purchased U.S. LNG directly.

Ukraine's agriculture industry has lost $80 billion due to Russian invasion, minister says

This figure includes direct and indirect damage caused by disrupted logistics, increased fertilizer and fuel costs, expenses for land reclamation and demining, and occupied territories, Agriculture Minister Vitalii Koval said on Feb. 25 during a World Bank report presentation. The agricultural sector plays a vital role in Ukraine's economy, comprising approximately 20% of the country's GDP.

Subscribe to the Newsletter

Ukraine Business Roundup

.png)

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)  10 hours ago

1

10 hours ago

1

Comments